____________________________________________________________________________________

____________________________________________________________________________________

____________________________________________________________________________________

4) Proposed maximum aggregate value of transaction:

____________________________________________________________________________________

5) Total fee paid:

[_] Fee paid previously with preliminary materials:

[_] Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which

the offsetting fee was paidpreviously. Identify the previous filing by registration statement number,or the form or

schedule and the date of its filing.

____________________________________________________________________________________

1) Amount previously paid:

2) Form, Schedule or Registration Statement No.:

____________________________________________________________________________________

3) Filing Party:

4) Date Filed:

PROXY

PROXY STATEMENT

AND

2006 ANNUAL REPORT

________

| Fiscal Year | | 2005 (1) | | 2004 (1) | | Percent Change (2) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sales | $ | 60,553 | $ | 56,434 | 7.3 | % | ||||||||

| Operating Profit | $ | 2,035 | $ | 843 | 141.4 | % | ||||||||

| Net earnings (loss) per share | $ | 1.31 | $ | (0.14 | ) | N/A | ||||||||

| Average shares used in calculation | 731 | 736 | (0.7 | )% | ||||||||||

| Net cash provided by operating activities | $ | 2,192 | $ | 2,330 | (5.9 | )% | ||||||||

| Capital expenditures | $ | 1,306 | $ | 1,634 | (20.1 | )% | ||||||||

| Identical supermarket sales (3) | $ | 54,143 | $ | 51,413 | 5.3 | % | ||||||||

| Identical supermarket sales excluding supermarket fuel operations (3) | $ | 50,866 | $ | 49,154 | 3.5 | % | ||||||||

| Comparable supermarket sales (4) | $ | 55,607 | $ | 52,514 | 5.9 | % | ||||||||

| Comparable supermarket sales excluding supermarket fuel operations (4) | $ | 52,200 | $ | 50,226 | 3.9 | % | ||||||||

| FINANCIALHIGHLIGHTS | ||||||||

| (in millions except per share data and percentages) | ||||||||

| Percent | ||||||||

| Fiscal Year | 2006 | 2005 | Change (1) | |||||

| Sales | $ | 66,111 | $ | 60,553 | 9.2 | % | ||

| Operating Profit | $ | 2,236 | $ | 2,035 | 9.9 | % | ||

| Net earnings per share | $ | 1.54 | $ | 1.31 | 17.6 | % | ||

| Average shares used in calculation | 723 | 731 | (1.1 | )% | ||||

| Net cash provided by operating activities | $ | 2,351 | $ | 2,192 | 7.3 | % | ||

| Capital expenditures | $ | 1,683 | $ | 1,306 | 28.9 | % | ||

| Identical supermarket sales (2) | $ | 59,592 | $ | 55,993 | 6.4 | % | ||

| Identical supermarket sales excluding fuel operations (2) | $ | 55,399 | $ | 52,483 | 5.6 | % | ||

| Comparable supermarket sales (3) | $ | 61,045 | $ | 57,203 | 6.7 | % | ||

| Comparable supermarket sales excluding supermarket fuel operations (3) | $ | 56,702 | $ | 53,622 | 5.7 | % | ||

| (1) |

| The percent calculations were based on the rounded numbers as presented. |

| We define a supermarket as identical when the store has been in operation and has not been expanded or relocated for five full quarters. Annualized identical supermarket sales are calculated as a summation of four quarters of identical sales. |

| We define a supermarket as comparable when the store has been in operation for five full quarters, including expansions and relocations. Annualized comparable supermarket sales are calculated as a summation of four quarters of comparable sales. |

COVER PRINTED ON RECYCLED PAPER

COVER PRINTED ON RECYCLED PAPER

Our results in 2006 clearly demonstrate that our Customer 1st strategy is working. We are focused on target and that, in implementing this strategy,listening to our people will continue to delight Customers and growoffering what they tell us is important to them. Whether it is faster checkouts, cleaner stores, more convenience or better value, each of us contributes to putting the Customer 1st every day, in every store. This is the foundation of our business.

REVIEWOF 2006

Kroger delivered consistently strong results in 2006, exceeding our original guidance for both identical supermarket sales and earnings per share growth.

QUARTERLY DIVIDEND INCREASED

On March 15, 2007, Kroger announced that our Board of Directors increased the quarterly dividend it pays shareholders by 15.4% to $0.075 per share. This strategy deploys cash to grow and maintainis the first increase in the quarterly dividend since the Board initiated the dividend program last year.

In keeping with the objectives outlined when the dividend policy was initiated, Kroger’s Board increased the amount after considering the Company’s asset base, reduce debt,overall results, the needs of the business and return valuethe interest of shareholders. This increase in the quarterly dividend reflects the Board’s confidence in our strategic plan.

IDENTICAL SALES GREW 5.6% WITHOUT FUEL

Our full-year identical supermarket sales growth in 2006, excluding fuel sales, was 5.6% – well in excess of our original goal, which was to shareholders through stock repurchases and now payment of a dividend.

EARNINGS PER SHARE GROWTHOF 15%

We ended the year with earnings per share growth of 15%, plus the additional value of our cash dividend program, far surpassing our original estimate of 6 – 8% growth in 2006. We raised that range to 8 – 10% during the year.

1

Our earnings per share growth was driven primarily by three factors: strong identical sales, slightly improving operating margins, and fewer shares outstanding.

Net earnings for the year were $1.1 billion, or $1.54 per diluted share. The 53rd week in the fiscal year provided an estimated benefit of $0.07 per diluted share.

COMPETITIVEADVANTAGES

As the retail food industry evolves, one certainty remains: the environment in which we initiatedoperate continues to be intensely competitive. We remain focused on our financial triple play strategy in January 2000, Kroger has reduced total debt by $1.8 billion and invested $3.0 billion to repurchase 155.7 million shares of stock.

- our people – a team of talented professionals focused on listening and responding to Customers;

•a high-quality asset base, with leading market shares in many of the nation’s largest and fastest growing- a high-quality asset base with leading market shares in many of the nation’s largest and fastest-growing markets;

•broad geographic diversity and multiple retail formats that allow Kroger to meet the needs of virtually every Customer; - broad geographic diversity and multiple retail formats that allow Kroger to meet the needs of our diverse Customers;

- our Customer loyalty card database, plus a unique data analysis capability;

- outstanding private-label products that have earned industry-leading market share; and

- a successful track record of competing head-to-head against supercenters.

TRONGM

Kroger also operates 779 convenience stores, currently operate in Phoenix, Arizona; Salt Lake City, Utah; and Columbus, Ohio. Kroger Marketplace will enter the Cincinnati market in 2006 with two stores. We are excited about our Marketplace412 fine jewelry stores and how they enable us to meet our Customers’ needs.

2

CUSTOMER INSIGHT

Over the past several years, Kroger has oneaccumulated a substantial database that provides valuable insight into the shopping behaviors of the most robust retail customer databases in America.our Customers through our store loyalty card programs. More than 20 million households actively use one of our store loyalty cards. The data from these cards provides us with valuable insights into our Customers’ shopping behaviors.

EADING C

Today, more than 10,000 corporate brand products are available only in Kroger’s family of stores. Our private label grocery items, in terms of dollars, represent approximately 24% of the Company’s grocery sales.

Most of our high-quality, private-label products are made in one of our 42 manufacturing plants.

We continue to face competitive challenges on a budget. Our banner brands, either Kroger or the name of the retail store, offer excellent quality and value and come with a guarantee that consumers can “try it, like it, or get the national brand free.” Private Selection is Kroger’s premium brand, offering the finest quality—again at attractive prices.

As in 2006, strong identical sales, slightly improving operating margins, and fewer shares outstanding will drive Kroger’s earnings per share growth this year.

Kroger’s quarterly cash dividend is an important component of shareholder return. We expect the combination of the Company’s dividend and earnings per share target of $1.60 to exceed their expectations better than anyone else. These are difficult challenges, but we are confident$1.65 to deliver a double-digit return for Kroger people are up to the task.

As in the past, these labor negotiations will be challenging in the face of competitive pressures and rising pension and health care costs. We will continue to seek balanced agreements that provide good wages and benefits at a cost that is fair to all.

43

Last year, our family of the A2H network. Kroger is a major contributor to the national fight to end hunger. In 2005, we supported food banks with donations of time, expertise, funds andstores contributed more than 2930 million pounds of food and groceryother products valued at $43.7 million.

| Jim Herzberg, Atlanta Division | |

| Betty Porter, Central Division | |

| Keith Eve, Cincinnati/Dayton Division | |

| Kevin Flohr, City Market | |

| Gary L. Moore, Delta Division | |

| Mariana Barrenechea, Dillon Stores | |

| Marnie L. Green, Food 4 Less | |

| Cindi Corderman, Fred Meyer | |

| Randy Poston, Fry’s | |

| Dave Fannin, Great Lakes Division | |

| Mark Combs, Jay C Stores | |

| Matt LeClaire, King Soopers | |

| Ed Southern, Mid-Atlantic | |

| Dorian Shields, Mid-South | |

| Sue Brooks, QFC | |

| Debbie Muhler, Ralphs | |

| Emily Brito, Smith’s | |

| Jim Dickinson, Southwest Division | |

| Veronica Johnson, Country Oven Bakery | |

| Lisa Webb, Pace Dairy | |

| Lewis and Maria Tracy, Layton Dairy | |

| Art Anderson, Delight Products | |

| Anne Sturgis, General Office |

ENVIRONMENTAL STEWARDSHIP

4

We have learned that one of travel distribution services for Cendant Corporation, Senior Vice President for technology at eBay Inc.,the most effective ways to reduce energy consumption is by establishing best practices, which we do with the help of every Associate in every store. Our local energy teams create and Senior Vice Presidentimplement store-specific energy reduction plans. We also have programs in place to train and CIO for Federal Express Corporation. Technology is a critical factor in Kroger’s ability to serve our Customers, partner with our suppliers, and empowereducate all of our Associates and we are pleased to have Mr. Hjelm leading ourabout good energy habits.

Our ongoing efforts in this area.

Diversity is one of Kroger’s core values and to underscore its importance, Kroger named Carver Johnson as the Company’s first Chief Diversity Officer last year. Mr. Johnson, who has been with Kroger since 1999, and his team focus on hiring, training and retaining a diverse work force and oversee Kroger’s supplier diversity efforts. Kroger has been a leader in the use of minority and women-owned business enterprises (M/WBE) in all aspects of our business for more than 25 years, spending $1 billion annually with M/WBEs.

Several individuals were named to lead retail divisions this year, continuing Kroger’s strong track record of developing leaders and creating opportunities for them within the Company.

Robert Moeder was named President of Kroger’s Central Division, bringing more than 30 years of retail and division management experience in Kroger to his new position. Mark Prestidge was promoted to President of Kroger’s Delta Division, after holding several leadership positions in the supermarket industry.Michael Ellis was named President of the Company’s Fred Meyer division after serving in several leadership positions within Kroger.

On behalf of our entire Company, we extend our appreciation and congratulations to John Burgon, Senior Vice President,Richard Tillman, who retired after 33 years in the grocery business. Mr. Burgon began hisa 42-year career with King SoopersKroger. Mr. Tillman joined Kroger as a producepart-time food store clerk and held a variety of upper-level management positions within several Kroger divisions,with increasing responsibility throughout his career, including presidentPresident of RalphsKroger’s Delta division.

DELIVERING IMPROVED SERVICE, SELECTIONAND VALUE

Kroger’s Customer 1st strategic plan served Customers, Associates and president of King Soopers.

We must continue to listen closely to our Customers—to truly hear what they say about usCustomers and how well we are meetingput their expectations. We must embrace change. And above all, we must put our Customers first—expectations and needs first – in every store, inarea of our business, every decision, every day.

David B. Dillon

Chairman of the Board and

Chief Executive Officer

of The Kroger Co.:

| 1. | To elect |

| 2. | To consider, act upon and approve | ||

| 3. | To consider, act upon and approve a proposal on rules of conduct for shareholder meetings and meetings outside of Cincinnati; | ||

| 4. | To consider and act upon a proposal to ratify the selection of independent auditors for the year | ||

| 5. | To act upon | ||

| 6. | To transact such other business as may properly be brought before the meeting; | ||

| By order of the Board of Directors, | |

| Paul W. Heldman, Secretary |

Item No. 3, below is adopted. The affirmative vote representing at least 75% of the outstanding shares of our common stock is required to amend Kroger’s Regulations to provide for annual election of all directors. Abstentions and broker non-votes will have the same effect as votes against this proposal.

97

(ITEM NO. 1)

| Professional | Director | ||||

| Name | Occupation (1) | Age | Since | ||

| NOMINEES FORDIRECTOR FOR TERMS OFOFFICE | |||||

| CONTINUINGUNTIL2008 | |||||

| Reuben V. Anderson | Mr. Anderson is a member in the Jackson, Mississippi, office of Phelps Dunbar, a regional law firm based in New Orleans. Prior to joining this law firm, he was a justice of the Supreme Court of Mississippi. Mr. Anderson is a director of Trustmark National Bank and AT&T Inc. He is a member of the Corporate Governance and Public Responsibilities Committees. | 64 | 1991 | ||

| John L. Clendenin | Mr. Clendenin is Chairman Emeritus of BellSouth Corporation, a holding company with subsidiaries in the telecommunications business. From January 1984 through December 1996 he was its Chairman of the Board and Chief Executive Officer. Mr. Clendenin is a director of Equifax Incorporated, The Home Depot, Inc., Powerwave Technologies, Inc., and Acuity Brands, Inc. He is a member of the Compensation and Corporate Governance Committees. | 72 | 1986 | ||

8

Reuben V. Anderson | Mr. Anderson is a member in the Jackson, Mississippi, office of Phelps Dunbar, a regional law firm based in New Orleans. Prior to joining this law firm, he was a justice of the Supreme Court of Mississippi. Mr. Anderson is a director of Trustmark National Bank and BellSouth Corporation. He is a member of the Audit and Public Responsibilities Committees. | 63 | 1991 | |||||||||||

Don W. McGeorge | Mr. McGeorge was elected President and Chief Operating Officer of Kroger in 2003. Before that he was elected Executive Vice President in 2000 and Senior Vice President in 1997. | 51 | 2003 | |||||||||||

W. Rodney McMullen | Mr. McMullen was elected Vice Chairman of Kroger in 2003. Before that he was elected Executive Vice President in 1999 and Senior Vice President in 1997. Mr. McMullen is a director of Cincinnati Financial Corporation. | 45 | 2003 | |||||||||||

Clyde R. Moore | Mr. Moore is the Chairman and Chief Executive Officer of First Service Networks, a national provider of facility and maintenance repair services. He is a director of First Service Networks. Mr. Moore is a member of the Audit and Public Responsibilities Committees. | 52 | 1997 | |||||||||||

| Professional | Director | ||||

| Name | Occupation (1) | Age | Since | ||

| David B. Dillon | Mr. Dillon was elected Chairman of the Board of Kroger in 2004, Chief Executive Officer in 2003, and President and Chief Operating Officer in 2000. He served as President in 1999, and as President and Chief Operating Officer from 1995-1999. Mr. Dillon was elected Executive Vice President of Kroger in 1990 and President of Dillon Companies, Inc. in 1986. He is a director of Convergys Corporation. | 56 | 1995 | ||

| David B. Lewis | Mr. Lewis is Chairman, President and Chief Executive Officer of Lewis & Munday, a Detroit based law firm with offices in Washington, D.C. and Seattle. He is a director of H&R Block. Mr. Lewis has served on the Board of Directors of Conrail, Inc., LG&E Energy Corp., Lewis & Thompson Agency, Inc., M.A. Hanna, TRW, Inc. and Comerica, Inc. He is chair of the Audit Committee and vice chair of the Public Responsibilities Committee. | 62 | 2002 | ||

| Don W. McGeorge | Mr. McGeorge was elected President and Chief Operating Officer of Kroger in 2003. Before that he was elected Executive Vice President in 2000 and Senior Vice President in 1997. | 52 | 2003 | ||

| W. Rodney McMullen | Mr. McMullen was elected Vice Chairman of Kroger in 2003. Before that he was elected Executive Vice President in 1999 and Senior Vice President in 1997. Mr. McMullen is a director of Cincinnati Financial Corporation. | 46 | 2003 | ||

| Jorge P. Montoya | Mr. Montoya was the President of The Procter& Gamble Company’s Global Snacks & Beverage division, and President of Procter & Gamble Latin America, from 1999 until his retirement in 2004.Prior to that, he was an Executive Vice President of Procter & Gamble from 1995 to 1999. Mr. Montoya is a director of Gap, Inc. and Rohm & Haas Company.He is a member of the Compensation and Public Responsibilities Committees. | 60 | 2007 | ||

| Clyde R. Moore | Mr. Moore is the Chairman and Chief Executive Officer of First Service Networks, a national provider of facility and maintenance repair services. He is a director of First Service Networks. Mr. Moore is a member of the Audit and Compensation Committees. | 53 | 1997 | ||

9

Robert D. Beyer | Mr. Beyer is Chief Executive Officer of The TCW Group, Inc., an investment management firm, where he has been employed since 1995. From 1991 to 1995, he was the co-Chief Executive Officer of Crescent Capital Corporation, which was acquired by TCW in 1995. Mr. Beyer is also a member of the Board of Directors of TCW and its ultimate parent, Société Générale Asset Management, S.A. He is chair of the Financial Policy Committee and a member of the Compensation Committee. | 46 | 1999 | |||||||||||

John T. LaMacchia | Mr. LaMacchia is Chairman of the Board of Tellme Networks, Inc., a provider of voice application networks. From September 2001 through December 2004 he was also Chief Executive Officer of Tellme Networks. From October 1993 through February 1999, Mr. LaMacchia was President and Chief Executive Officer of Cincinnati Bell Inc. From May 1999 to May 2000 he was Chief Executive Officer of CellNet Data Systems, Inc., a provider of wireless data communications. Mr. LaMacchia is a director of Tellme Networks, Inc. He is chair of the Compensation Committee and a member of the Corporate Governance Committee. | 64 | 1990 | |||||||||||

Katherine D. Ortega | Ms. Ortega served as an Alternate Representative of the United States to the 45th General Assembly of the United Nations in 1990-1991. Prior to that, she served as Treasurer of the United States. Ms. Ortega is a director of Rayonier Inc., Washington Mutual Investors Fund and JPMorgan Value Opportunities Fund, and Trustee of the American Funds Tax Exempt Series I. She is chair of the Public Responsibilities Committee and a member of the Corporate Governance Committee. | 71 | 1992 | |||||||||||

| Professional | Director | ||||

| Name | Occupation (1) | Age | Since | ||

| Susan M. Phillips | Dr. Phillips is Dean and Professor of Finance at The George Washington University School of Business, a position she has held since 1998. She was a member of the Board of Governors of the Federal Reserve System from December 1991 though June 1998. Before her Federal Reserve appointment, Dr. Phillips served as Vice President for Finance and University Services and Professor of Finance in The College of Business Administration at the University of Iowa from 1987 through 1991. She is a director of State Farm Mutual Automobile Insurance Company, State Farm Life Insurance Company, State Farm Companies Foundation, National Futures Association, the Chicago Board Options Exchange and the Chicago Futures Exchange. Dr. Phillips also is a trustee of the Financial Accounting Foundation. She is a member of the Audit and Financial Policy Committees. | 62 | 2003 | ||

| Steven R. Rogel | Mr. Rogel was elected Chairman of the Board of Weyerhaeuser Company in 1999 and has been President and Chief Executive Officer and a director thereof since December 1997. Before that time he was Chief Executive Officer, President and a director of Willamette Industries, Inc. Mr. Rogel served as Chief Operating Officer of Willamette Industries, Inc. until October 1995 and, before that time, as an executive and group vice president for more than five years. He is a director of Union Pacific Corporation. Mr. Rogel has been appointed by the Board to serve as Lead Director. He is chair of the Corporate GovernanceCommittee and a member of the Financial Policy Committee. | 64 | 1999 | ||

| James A. Runde | Mr. Runde is a special advisor and a former Vice Chairman of Morgan Stanley, where he has been employed since 1974. He was a member of the Board of Directors of Burlington Resources Inc. prior to its acquisition by ConocoPhillips in 2006. Mr. Runde serves as a trustee of Marquette University and the Pierpont Morgan Library. He is a member of the Compensation and Financial Policy Committees. | 60 | 2006 | ||

10

John L. Clendenin | Mr. Clendenin is Chairman Emeritus of BellSouth Corporation, a holding company with subsidiaries in the telecommunications business. From January 1984 through December 1996 he was its Chairman of the Board and Chief Executive Officer. Mr. Clendenin is a director of Equifax Incorporated, The Home Depot, Inc., Powerwave Technologies, Inc., and Acuity Brands, Inc. He is a member of the Compensation and Corporate Governance Committees. | 71 | 1986 | |||||||||||

David B. Dillon | Mr. Dillon was elected Chairman of the Board of Kroger in 2004, Chief Executive Officer in 2003, and President and Chief Operating Officer in 2000. He served as President in 1999, and as President and Chief Operating Officer from 1995-1999. Mr. Dillon was elected Executive Vice President of Kroger in 1990 and President of Dillon Companies, Inc. in 1986. He is a director of Convergys Corporation. | 55 | 1995 | |||||||||||

David B. Lewis | Mr. Lewis is Chairman, President and Chief Executive Officer of Lewis & Munday, a Detroit based law firm with offices in Washington, D.C. and Seattle. He is a director of H&R Block and Lewis & Thompson Agency, Inc. Mr. Lewis has served on the Board of Directors of Conrail, Inc., LG&E Energy Corp., M.A. Hanna, TRW, Inc. and Comerica, Inc. He is chair of the Audit Committee and vice chair of the Public Responsibilities Committee. | 61 | 2002 | |||||||||||

| Professional | Director | ||||

| Name | Occupation (1) | Age | Since | ||

| Ronald L. Sargent | Mr. Sargent is Chairman and Chief Executive Officer of Staples, Inc., where he has been employed since 1989. Prior to joining Staples, Mr. Sargent spent 10 years with Kroger in various positions. In addition to serving as a director of Staples, Mr. Sargent is a director of Mattel, Inc. He is a member of the Audit and Public Responsibilities Committees. | 51 | 2006 | ||

| DIRECTORSWHOSETERMSOFOFFICECONTINUEUNTIL 2008 | |||||

| Robert D. Beyer | Mr. Beyer is Chief Executive Officer of The TCW Group, Inc., an investment management firm, where he has been employed since 1995. From 1991 to 1995, he was the co-Chief Executive Officer of Crescent Capital Corporation, which was acquired by TCW in 1995. Mr. Beyer is a member of the Board of Directors of TCW and its parent, Société Générale Asset Management, S.A. He is also a member of the Board of Directors of The Allstate Corporation. Mr. Beyer is chair of the Financial Policy Committee and a member of the Compensation Committee. | 47 | 1999 | ||

| John T. LaMacchia | Mr. LaMacchia is Chairman of the Board of Tellme Networks, Inc., a provider of voice application networks. From September 2001 through December 2004 he was also Chief Executive Officer of Tellme Networks. From October 1993 through February1999, Mr. LaMacchia was President and Chief Executive Officer of Cincinnati Bell Inc. From May 1999 to May 2000 he was Chief Executive Officer of CellNet Data Systems, Inc., a provider of wireless data communications. He is chair of the Compensation Committee and a member of the Corporate Governance Committee. | 65 | 1990 | ||

| Katherine D. Ortega | Ms. Ortega served as an Alternate Representative of the United States to the 45th General Assembly of the United Nations in 1990-1991. Prior to that, she served as Treasurer of the United States. Ms. Ortega is a director of Rayonier Inc., Washington Mutual Investors Fund and JPMorgan Value Opportunities Fund, and Trustee of the American Funds Tax Exempt Series I. She is chair of the Public Responsibilities Committee and a member of the Financial Policy Committee. | 72 | 1992 | ||

11

| Professional | Director | ||||

| Name | Occupation (1) | Age | Since | ||

| Bobby S. Shackouls | Until the merger of Burlington Resources Inc. and ConocoPhillips, which became effective on March 31, 2006, Mr. Shackouls was Chairman of the Board of Burlington Resources Inc., a natural resources business, since July 1997 and its President and Chief Executive Officer since December 1995. He had been a director of that company since 1995 and President and Chief Executive Officer of Burlington Resources Oil and Gas Company (formerly known as Meridian Oil Inc.), a wholly-owned subsidiary of Burlington Resources, since 1994. Mr. Shackouls is a director of ConocoPhillips. He is vice chair of the Audit and Corporate Governance Committees. | 56 | 1999 | ||

| (1) | Except as noted, each of the directors has been employed by his or her present employer (or a subsidiary) in an executive capacity for at least five years. |

12

|

13

The Board elected Mr. Montoya, Mr. Runde and Mr. Sargent as directors to fill vacancies since the 2006 annual meeting. Non-management directors, our CEO, and a third-party search firm jointly recommended each of these directors.

CORPORATE GOVERNANCE

The Board of Directors has adoptedGuidelines on Issuesof Corporate Governance. TheseGuidelines, which include copies of the current charters for the Audit, Compensation and Corporate Governance Committees, and the other committees of the Board of Directors, are available on our corporate website at www.kroger.com.www.thekrogerco.com Shareholders may obtain a copy of theGuidelines by making a written request to Kroger’s Secretary at our executive offices.

NDEPENDENCE

14

CSHAREHOLDER COMMUNICATIONSWITHTHE BOARD

Governance Committee for further consideration. The chair of the Corporate Governance Committee will take such action as he or she deems appropriate, which may include referral to the Corporate Governance Committee or the entire Board.

| COMPENSATION DISCUSSIONAND ANALYSIS |

| SUMMARY COMPENSATION TABLE | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Annual Compensation | Long-Term Compensation | |||||||||||||||||||||||||||

| Awards | Payouts | |||||||||||||||||||||||||||

| Name and Principal Position | Year | | Salary ($) | | Bonus ($) | | Other Annual Compensation ($) | | Restricted Stock Awards ($) | | Securities Underlying Options/ SARs (#) | | LTIP Payouts ($) | | All Other Compensation ($) | |||||||||||||

| (1) | (2) | (3) | (4) | (5) | ||||||||||||||||||||||||

| David B. Dillon | 2005 | $ | 1,100,000 | $ | 1,940,131 | $ | 43,355 | $ | 0 | 300,000 | $ | 0 | $ | 62,407 | ||||||||||||||

| Chairman and Chief | 2004 | $ | 1,083,974 | $ | 736,361 | $ | 33,900 | $ | 0 | 300,000 | $ | 0 | $ | 52,256 | ||||||||||||||

| Executive Officer | 2003 | $ | 880,062 | $ | 244,962 | $ | 21,622 | $ | 2,517,000 | 0 | $ | 0 | $ | 28,575 | ||||||||||||||

| W. Rodney McMullen | 2005 | $ | 773,000 | $ | 1,221,870 | $ | 13,368 | $ | 0 | 75,000 | $ | 0 | $ | 20,186 | ||||||||||||||

| Vice Chairman | 2004 | $ | 772,647 | $ | 468,979 | $ | 10,469 | $ | 0 | 75,000 | $ | 0 | $ | 18,341 | ||||||||||||||

| 2003 | $ | 704,077 | $ | 181,865 | $ | 8,614 | $ | 1,678,000 | 0 | $ | 0 | $ | 14,333 | |||||||||||||||

| Don W. McGeorge | 2005 | $ | 773,000 | $ | 1,221,870 | $ | 29,903 | $ | 0 | 75,000 | $ | 0 | $ | 40,088 | ||||||||||||||

| President and Chief | 2004 | $ | 772,647 | $ | 468,979 | $ | 24,834 | $ | 0 | 75,000 | $ | 0 | $ | 35,155 | ||||||||||||||

| Operating Officer | 2003 | $ | 681,462 | $ | 176,298 | $ | 16,480 | $ | 1,678,000 | 0 | $ | 0 | $ | 23,509 | ||||||||||||||

| Paul W. Heldman | 2005 | $ | 618,000 | $ | 710,005 | $ | 20,829 | $ | 0 | 40,000 | $ | 0 | $ | 32,706 | ||||||||||||||

| Senior Vice President, | 2004 | $ | 617,808 | $ | 275,870 | $ | 19,577 | $ | 0 | 40,000 | $ | 0 | $ | 27,698 | ||||||||||||||

| Secretary and General | 2003 | $ | 567,739 | $ | 116,913 | $ | 14,934 | $ | 671,200 | 0 | $ | 0 | $ | 21,007 | ||||||||||||||

| Counsel | ||||||||||||||||||||||||||||

| Donald E. Becker | 2005 | $ | 536,250 | $ | 685,238 | $ | 24,780 | $ | 969,000 | 40,000 | $ | 0 | $ | 37,630 | ||||||||||||||

| Executive Vice President | 2004 | $ | 487,981 | $ | 242,978 | $ | 16,746 | $ | 156,500 | 40,000 | $ | 0 | $ | 25,503 | ||||||||||||||

| 2003 | $ | 438,462 | $ | 95,108 | $ | 14,214 | $ | 0 | 0 | $ | 0 | $ | 22,416 | |||||||||||||||

| Michael S. Heschel | 2005 | $ | 596,022 | $ | 772,750 | $ | 43,055 | $ | 0 | 45,000 | $ | 0 | $ | 71,072 | ||||||||||||||

| Former Executive Vice | 2004 | $ | 599,692 | $ | 297,940 | $ | 55,401 | $ | 0 | 45,000 | $ | 0 | $ | 84,310 | ||||||||||||||

| President and Chief | 2003 | $ | 578,077 | $ | 130,275 | $ | 44,244 | $ | 419,500 | 0 | $ | 0 | $ | 68,183 | ||||||||||||||

| Information Officer | ||||||||||||||||||||||||||||

- Make total compensation competitive;

- Include opportunities for equity ownership as part of compensation; and

our subsidiaries. - Use incentive compensation to help drive performance by providing superior pay for superior results.

The following table shows option grants in fiscal year 2005 todiscussion and analysis addresses the named executive officers:

| OPTION/SAR GRANTS IN LAST FISCAL YEAR | |||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Individual Grants | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term | ||||||||||||||||||||||||||||||

| Name | | Number of Securities Underlying Options/SAR Granted | | % of Total Options/SARs Granted to Employees in Fiscal Year | | Exercise or Base Price ($/Share) | | Expiration Date | | 0% | | 5% | | 10% | |||||||||||||||||

| David B. Dillon | 300,000 | 4.41 | % | $ | 16.39 | 5/5/2015 | $ | 0 | $ | 3,091,332 | $ | 7,834,041 | |||||||||||||||||||

| W. Rodney McMullen | 75,000 | 1.10 | % | $ | 16.39 | 5/5/2015 | $ | 0 | $ | 772,833 | $ | 1,958,510 | |||||||||||||||||||

| Don McGeorge | 75,000 | 1.10 | % | $ | 16.39 | 5/5/2015 | $ | 0 | $ | 772,833 | $ | 1,958,510 | |||||||||||||||||||

| Paul W. Heldman | 40,000 | 0.59 | % | $ | 16.39 | 5/5/2015 | $ | 0 | $ | 412,178 | $ | 1,044,539 | |||||||||||||||||||

| Donald E. Becker | 40,000 | 0.59 | % | $ | 16.39 | 5/5/2015 | $ | 0 | $ | 412,178 | $ | 1,044,539 | |||||||||||||||||||

| Michael S. Heschel | 45,000 | 0.66 | % | $ | 16.39 | 5/5/2015 | $ | 0 | $ | 463,700 | $ | 1,175,106 | |||||||||||||||||||

EXECUTIVE COMPENSATION – OBJECTIVES

The Committee has several related objectives regarding compensation. First, the Committee believes that compensation must be designed to attract and retain those best suited to fulfill the challenging roles that executive officers play at Kroger. Second, some elements of compensation should help align the interests of the officers with your interests as shareholders. Third, compensation should create strong incentives for the officers (a) to achieve the annual business plan targets established by the Board, and (b) to assure that the officers work within the framework of Kroger’s long-term strategic objectives. In developing compensation programs and amounts to meet these objectives, the Committee exercises restraint to assure that executive officer compensation does not exceed reasonable and competitive levels in light of Kroger’s performance and the needs of the business.

To meet these objectives, the Committee has taken a number of steps over the last several years, including the following:

- Conducted an annual review of all components of executive officer compensation, quantifying total compensation on tally sheets. The review includes an assessment for each officer, including the CEO, of salary; performance-based cash compensation, or bonus; equity and long-term incentive compensation; accumulated realized and unrealized stock option gains and restricted stock values; the value of

unexercised options:

| AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND FY-END OPTION/SAR VALUES TABLE | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | | Shares Acquired on Exercise (#) | | Value Realized ($) | | Number of Securities Underlying Unexercised Options/SARs at F/Y End (1) (#) Exercisable/ Unexercisable | | Value of Unexercised In-the-Money Options/SARs at F/Y End (1) ($) Exercisable/ Unexercisable | |||||||||||

| David B. Dillon | 172,000 | $ | 1,669,930 | 576,000/849,000 | $ | 1,188,580/$1,333,247 | |||||||||||||

| W. Rodney McMullen | 40,000 | $ | 388,900 | 450,000/355,000 | $ | 1,342,238/$507,580 | |||||||||||||

| Don McGeorge | 48,000 | $ | 493,440 | 422,500/347,500 | $ | 1,802,385/$507,580 | |||||||||||||

| Paul W. Heldman | 50,000 | $ | 477,250 | 322,499/208,001 | $ | 1,050,392/$283,884 | |||||||||||||

| Donald E. Becker | 16,000 | $ | 152,720 | 276,999/194,001 | $ | 938,340/$274,003 | |||||||||||||

| Michael S. Heschel | 0 | $ | 0 | 534,000/45,000 | $ | 1,108,766/$98,325 | |||||||||||||

16

- Recommended share ownership guidelines, adopted by the

New York Stock Exchange.Board of Directors. These guidelines require directors, officers and some other key executives to acquire and hold a minimum dollar value of Kroger stock. TheCommittee is responsibleguidelines require the CEO to acquire and maintain ownership of Kroger shares equal to 5 times his base salary; the Vice Chairman and the Chief Operating Officer to acquire and maintain ownership at 4 times their base salaries; Executive Vice Presidents, Senior Vice Presidents and non-employee directors at 3 times their base salaries or annual cash retainers; and other officers and key executives at 2 times their base salaries.

ESTABLISHING EXECUTIVE COMPENSATION

The independent members of the Board have the exclusive authority to determine the amount of the CEO’s salary; the bonus level for the approvalCEO; the nature and administrationamount of any equity awards made to the base salaryCEO; and any other compensation questions related to the CEO. In setting the “bonus level” for the CEO, the independent directors determine the dollar amount that will be multiplied by the percentage payout under the annual bonus plan applicable to all corporate management. The independent directors retain discretion to reduce the percentage payout the CEO would otherwise receive. The independent directors thus make a separate determination annually concerning both the CEO’s bonus level and bonus compensation programs, as well as the equity incentive program forpercentage of bonus paid.

The Committee performs the same function and exercises the same authority as to the other named executive officers.

- A detailed report, by officer, that

generally aredescribes current compensation, the value of equity compensation previously awarded, the value of retirement benefits earned, and any severance or other benefits payable upon a change of control. - An internal equity comparison of compensation at

or abovevarious senior levels. This current and historical analysis is undertaken to assure that themedian compensation paid by competitors for comparable positions (where data for comparable positions are available) with an annual bonus potential that, if the annual bonus plan goals are realized, would cause their total cashrelationship of CEO compensation tobe above the median,other senior officer compensation, and senior officer compensation to other levels in thethird quartile.

In considering each of the factors above, the Committee does not make use of a formula, but rather subjectively reviews each in making its compensation determination.

17

THE COMMITTEE’S COMPENSATION CONSULTANTAND BENCHMARKING

The Committee directly engages a compensation consultant from Mercer Human Resource Consulting anto advise the Committee in the design of compensation for executive compensation consulting firm, to perform competitive peer analysisofficers. While the parent and to determine whether the compensationaffiliated companies of the executive officers actually met our compensation philosophy. In conjunction with Kroger, Mercer Human Resource Consulting identified a group of peer retail companies, based primarily on similarity of lines of business, against which officer compensation is measured. Mercer Human Resource Consulting concludedperform other services for us, the Committee has found that the total compensation of the executive officers was at or near the median of the peer companies. The Committee has concluded that the compensation consultant is independent in part because (a) he was first engaged by the Committee before he became associated with Mercer; (b) he works exclusively for the Committee and not for managementour management; and (c) he does not benefit from the other work that Mercer performs for Kroger.

The consultant conducts an annual competitive assessment of Kroger.executive positions at Kroger for the Committee. The assessment is one of several bases, as described above, on which the Committee determines compensation. The consultant assesses base salary; target annual performance-based bonus; target cash compensation (the sum of salary and bonus); annualized long-term incentive awards, such as stock options, other equity awards, and performance-based long-term bonuses; and total direct compensation (the sum of all these elements). The consultant compares these elements against those of other companies in a peer group of publicly-traded food and drug retailers. For 2006, the group consisted of:

| Albertson’s | Safeway | |

| Costco Wholesale | Supervalu | |

| CVS | Target | |

| Great Atlantic & Pacific Tea | Walgreens | |

| Rite Aid | Wal-Mart |

The make-up of the compensation peer group is reviewed annually and modified as circumstances warrant. Industry consolidation and other competitive forces will change the peer group used. The consultant also provides the Committee data from companies in “general industry,” a representation of major publicly-traded companies. These data are a reference point, particularly for senior staff positions where competition for talent extends beyond the retail sector.

Based in part on the analysis performed by the Committee’s compensation consultant, the Committee concluded in 2005 that when comparing total compensation of the named executive officers to that of the peer group:

- cash compensation for the named executive officers as a group fell approximately at the median, and

- long-term compensation for the named executive officers fell substantially below the median.

As a result, the Committee determined to increase the potential for the named executive officers to earn long-term compensation through the adoption of a performance-based long-term bonus plan. The long-term bonus plan is discussed in more detail below.

18

COMPONENTSOF EXECUTIVE COMPENSATIONAT KROGER

Compensation for our named executive officers is comprised of the following:

- Salary

- Performance-Based Annual Cash Bonus (annual, non-equity incentive pay)

- Performance-Based Long-Term Cash Bonus (long-term, non-equity incentive pay)

- Equity

- Retirement and other benefits

- Perquisites

SALARY

We provide our named executive officers and other employees a fixed amount of cash compensation—salary—for the executive’s work. Salaries for named executive officers are established each year by the Committee. Salaries for the named executive officers typically are reviewed in May of each year.

The amount of each executive’s salary is influenced by numerous factors including:

- An assessment of individual contribution in the judgment of the CEO and the Committee (or, in thecase of the CEO, of the Committee)

- Benchmarking with comparable positions at peer group companies

- Tenure with Kroger

- Relationship with the salaries of other executives at Kroger.

In 2006, the named executive officers by evaluating both the most recent comparative peer data available and each officer’s role and responsibilities. The Committee reviews individual salaries on an annual basis and basesreceived salary increases on Kroger’s overall performance as well asfollowing the executive’s performance, roleannual review of their compensation in May.

| Salaries | |||||

| 2005 | 2006 | ||||

| David B. Dillon | $ | 1,100,000 | $ | 1,150,000 | |

| J. Michael Schlotman | $ | 450,000 | $ | 505,000 | |

| W. Rodney McMullen | $ | 773,000 | $ | 805,000 | |

| Don W. McGeorge | $ | 773,000 | $ | 805,000 | |

| Donald E. Becker | $ | 540,000 | $ | 575,000 | |

The increases for Mr. Becker and contribution.

19

The Committee considers several factors in making its determination or recommendation as to bonus potentials. First, the Committee’s February 27, 2006 meeting,individual’s level within the Committee discussed bonus payments to the executive officers and considered performance as compared to the goalsorganization is a factor in that the Committee believes that more senior executives should have a greater part of their compensation dependant upon Kroger’s performance. Second, the individual’s salary is a factor so that a substantial portion of a named executive officer’s total cash compensation is dependant upon Kroger’s performance. Finally, the Committee considers the report of its compensation consultant to assess the bonus potential of the named executive officers in light of total compensation paid to comparable executive positions in the industry.

The bonus potential of each named executive officer for 2005 and 2006 is shown below. Mr. Becker’s bonus potential was increased because of an increase in salary and responsibility.

| Bonus | |||||

| 2005 | 2006 | ||||

| David B. Dillon | $ | 1,500,000 | $ | 1,500,000 | |

| J. Michael Schlotman | $ | 450,000 | $ | 450,000 | |

| W. Rodney McMullen | $ | 950,000 | $ | 950,000 | |

| Don W. McGeorge | $ | 950,000 | $ | 950,000 | |

| Donald E. Becker | $ | 525,000 | $ | 550,000 | |

The amount of bonus that the named executive officers earn each year is determined by Kroger’s performance compared to targets established by the Committee based on the business plan adopted by the Board of Directors. In 2006, thirty percent of bonus was earned based on an identical sales target; thirty percent was based on a target for EBITDA; thirty percent was based on a set of measures for implementation and results under our strategic plan; and ten percent was based on the 2005 plan year. Based on performance of new capital projects compared to their budgets. Targets in all cases allow for minimal bonus to be earned at relatively low levels to provide incentive for achieving even higher levels of performance. The extent to which Kroger fell short of, met, or exceeded the targets established in each of these areas at the beginning of 2006 determined the percentage of each named executive officer’s bonus potential paid for 2006.

In 2006, as in all years, the Committee retained discretion to reduce the bonus payout for named executives officers if the Committee determined for any reason that Kroger (i) had exceeded its EBITDA objective, (ii) had exceeded itsthe bonus payouts were not appropriate.The independent directors retained that discretion for the CEO’s bonus. Those bodies also retained discretion to adjust the targets under the plan should unanticipated developments arise during the year.

Following the close of the year, the Committee reviewed Kroger’s performance against the identical sales, objective, (iii) had substantially achieved its objective for execution of theEBITDA, strategic plan and (iv) had exceededcapital projects objectives. The Committee made one adjustment that reduced the minimum sales and EBIDTA thresholds established for its capital projects. As a result,bonuses of the Committee determined that thenamed executive officers had earned 132.094% of their bonus potentials, which was slightlyby less than the 133.522% applicable to all other eligible employees participating in the corporate bonus plan.one percent. The Committee determined that income from the officers weresale of certain assets should not eligible to receive certain adjustments that causedbe included in EBITDA for purposes of the bonus payoutcalculation. The independent members of the Board made the same adjustment, resulting in the same reduction of bonus, for the CEO. No other eligible participants to be higher.adjustments were made. As a result, each of the named executive officers earned 141.118% of their bonus potentials.

20

The percentage paid for 2006 represented and resulted from an extraordinary performance against the business plan objectives. A comparison of bonus percentages for the named executive officers in prior years demonstrates the variability of incentive compensation:

| Fiscal Year | Bonus Percentage | ||||

| 2006 | 141.118 | % | |||

| 2005 | 132.094 | % | |||

| 2004 | 55.174 | % | |||

| 2003 | 24.1 | % | |||

| 2002 | 9.9 | % | |||

The actual payout percentages reflectamounts of annual performance-based cash bonuses paid to the extent to which Kroger achievednamed executive officers for 2006 are shown in the 2005Summary Compensation table under the heading “Non-Equity Incentive Plan Compensation.” These amounts represent the bonus objectives establishedpotentials for each named executive officer multiplied by the Committee.

- improving its performance in four key categories, based on results of customer

surveys,surveys; and(ii) - reducing total operating costs as a percentage of sales, excluding fuel.

- The compensation consultant’s benchmarking report regarding equity-based and other long-term compensation awarded by our competitors;

- The officer’s level in the organization and the internal

equity is an important factor to be considered in establishing compensation for the officers. While the Committee has not established a policy regarding the ratiorelationship oftotal compensationequity-based awards within Kroger; - Individual performance; and

- The recommendation of the

Chief Executive Officer to thatCEO, for all named executive officers other than in the case of theother officers, it does review compensation levels to ensure that appropriate equity exists. The Committee intends to continue to review internal compensation equity and may adopt a formal policy if it deems such adoption would be appropriate.

Amounts of equity awards issued and outstanding for the Board regarding the Chief Executive Officer’s compensation, the aggregate amounts and mix of all of the components, including accumulated (realized and unrealized) option and restricted stock gains,named executive officers are taken into considerationset forth in the Committee’s decisions.

Kroger maintains a defined benefit and several defined contribution retirement plans for its employees.The Committee and the Board of Directors believe that the caliber and motivation of all of our employees, including our executive leadership, are essential to Kroger’s performance. We believe our management compensation programs contribute to our ability to differentiate our performance from others in the marketplace. We will continue to administer our compensation program in a manner that we believe will be in the shareholders’ interests.

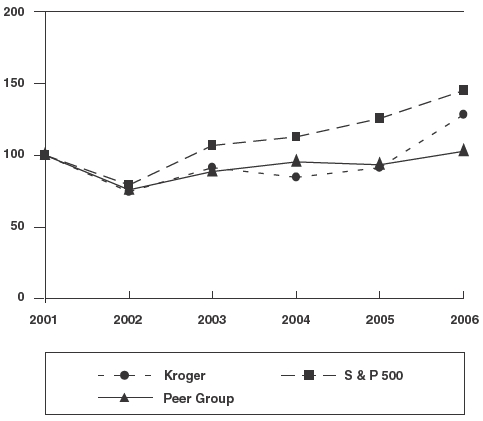

| INDEXED RETURNS Years Ending | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Company Name / Index | | Base Period 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | |||||||||||||||

THE KROGER CO | 100 | 82.61 | 61.32 | 75.29 | 70.05 | 75.46 | |||||||||||||||||||||

S&P 500 INDEX | 100 | 83.99 | 66.77 | 89.85 | 94.65 | 105.66 | |||||||||||||||||||||

PEER GROUP | 100 | 100.68 | 76.57 | 89.33 | 95.64 | 93.76 | |||||||||||||||||||||

| Years of Service | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Five Year Average Remuneration | 15 | 20 | 25 | 30 | 35 | 40 | ||||||||||||||||||||||

| $ | 150,000 | $ | 33,750 | $ | 45,000 | $ | 56,250 | $ | 67,500 | $ | 78,750 | $ | 90,000 | |||||||||||||||

| 250,000 | 56,250 | 75,000 | 93,750 | 112,500 | 131,250 | 150,000 | ||||||||||||||||||||||

| 450,000 | 101,250 | 135,000 | 168,750 | 202,500 | 236,250 | 270,000 | ||||||||||||||||||||||

| 650,000 | 146,250 | 195,000 | 243,750 | 292,500 | 341,250 | 390,000 | ||||||||||||||||||||||

| 850,000 | 191,250 | 255,000 | 318,750 | 382,500 | 446,250 | 510,000 | ||||||||||||||||||||||

| 900,000 | 202,500 | 270,000 | 337,500 | 405,000 | 472,500 | 540,000 | ||||||||||||||||||||||

| 1,200,000 | 270,000 | 360,000 | 450,000 | 540,000 | 630,000 | 720,000 | ||||||||||||||||||||||

| 1,500,000 | 337,500 | 450,000 | 562,500 | 675,000 | 787,500 | 900,000 | ||||||||||||||||||||||

| 1,800,000 | 405,000 | 540,000 | 675,000 | 810,000 | 945,000 | 1,080,000 | ||||||||||||||||||||||

| 2,200,000 | 495,000 | 660,000 | 825,000 | 990,000 | 1,155,000 | 1,320,000 | ||||||||||||||||||||||

22

a change in control of Kroger (as defined in the plan). Participants who are at least 40 and who have more than six years of service are entitled to severance pay ranging from approximately 9 to 20 months’ salary and bonus. The actual amount is dependent upon pay level and other benefits. KEPP can be amended or terminated by the Board at any time prior to a change in control. It will expire in 2008 unless renewed by the Board.

Stock option and restricted stock agreements with participants in Kroger’s long-term incentive plans provide that those awards “vest,” with options becoming immediately vested and restrictions on restricted stock lapsing, upon a change in control as described in the agreements.

None of the named executive officers is party to an employment agreement. The CEO did have an employment contract that expired on November 30, 2006, and was not renewed.

PERQUISITES

The Committee does not believe that it is necessary for the attraction or retention of management talent to provide the named executive officers a substantial amount of compensation in the form of perquisites.In 2006, the only perquisites provided were:

- personal use of Kroger aircraft, which officers may lease from Kroger, and pay the average variable cost of operating the aircraft, making officers more available and allowing for a more efficient use of their time,

- payments of premiums of life insurance policies, and reimbursement of the tax effects of those payments,

- reimbursement for the tax effects of participation in a non-qualified retirement plan, and

- reimbursement of up to $4,500 for financial planning services, which reimbursement has been discontinued in 2007.

The total amount of perquisites furnished to the named executive officers is shown in the Summary Compensation table and described in more detail in footnote 5 to that table.

SECTION 162(M)OFTHE INTERNAL REVENUE CODE

Tax laws place a limit of $1,000,000 on the amount of some types of compensation for the CEO and the next four most highly compensated officers that is tax deductible by Kroger. Compensation that is deemed to be “performance-based” is excluded for purposes of the calculation and is tax deductible.Awards under Kroger’s long-term incentive plans, when payable upon achievement of stated performance criteria, should be considered performance-based and the compensation paid under those plans should be tax deductible. Generally, compensation expense related to stock options awarded to the CEO and the next four most highly compensated officers should be deductible. On the other hand, Kroger’s awards of restricted stock that vest solely upon the passage of time and are not performance-based. As a result, compensation expense for those awards to the CEO and the next four most highly compensated officers would not be deductible.

Although Kroger’s bonus plans are not discretionary but rather rely on performance criteria, these plans have not been approved by shareholders in the past. As a result, they currently do not satisfy the Internal Revenue Code’s requirements for deductibility. At the 2007 annual meeting of shareholders Kroger is submitting for approval of shareholders (see Item No. 2 below) its cash bonus plan. If approved by shareholders, bonuses paid under the plan to the CEO and the next four most highly compensated officers will be deductible by Kroger. In Kroger’s case, this group of individuals is not identical to the group of named executive officers.

23

| Kroger’s policy is, primarily, to design and administer compensation plans that support the achievement of long-term strategic objectives and enhance shareholder value. Where it is material and supports Kroger’s compensation philosophy, the Committee also will attempt to maximize the amount of compensation expense that is deductible by Kroger. |

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed with management of the Company the Compensation Discussion and Analysis contained in this proxy statement. Based on its review and discussions with management, the Compensation Committee has recommended to the Company’s Board of Directors that the Compensation Discussion and Analysis be included in the Company’s proxy statement and incorporated by reference into its annual report on Form 10-K.

Compensation Committee:

John T. LaMacchia, Chair

Robert D. Beyer

John L. Clendenin

Jorge P. Montoya

Clyde R. Moore

James A. Runde

24

SUMMARY COMPENSATION TABLE

The following table shows the compensation of the Chief Executive Officer, Chief Financial Officer and each of the Company’s three most highly compensated executive officers other than the CEO and CFO (the “named executive officers”) during fiscal 2006. Fiscal year 2006 consisted of 53 weeks.

| SUMMARY COMPENSATION TABLE | |||||||||||||||||||||||||||||

| Change in | |||||||||||||||||||||||||||||

| �� | Pension | ||||||||||||||||||||||||||||

| Value and | |||||||||||||||||||||||||||||

| Nonqualified | |||||||||||||||||||||||||||||

| Non-Equity | Deferred | ||||||||||||||||||||||||||||

| Stock | Option | Incentive Plan | Compensation | All Other | |||||||||||||||||||||||||

| Name and Principal | Salary | Bonus | Awards | Awards | Compensation | Earnings | Compensation | Total | |||||||||||||||||||||

| Position | Year | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ||||||||||||||||||||

| (1) | (1) | (2) | (3) | (4) | |||||||||||||||||||||||||

| David B. Dillon | |||||||||||||||||||||||||||||

| Chairman and CEO | 2006 | $ | 1,155,991 | — | $ | 519,160 | $ | 3,311,870 | $ | 2,116,770 | $ | 1,008,309 | $ | 142,437 | $8,254,537 | ||||||||||||||

| J. Michael Schlotman | |||||||||||||||||||||||||||||

| Senior Vice | |||||||||||||||||||||||||||||

| President and CFO | 2006 | $ | 499,099 | — | $ | 97,835 | $ | 339,653 | $ | 635,031 | $ | 256,221 | $ | 31,819 | $1,859,658 | ||||||||||||||

| W. Rodney McMullen | |||||||||||||||||||||||||||||

| Vice Chairman | 2006 | $ | 809,969 | — | $ | 195,956 | $ | 794,327 | $ | 1,340,621 | $ | 360,184 | $ | 44,530 | $3,545,587 | ||||||||||||||

| Don W. McGeorge | |||||||||||||||||||||||||||||

| President and COO | 2006 | $ | 809,969 | — | $ | 195,956 | $ | 811,355 | $ | 1,340,621 | $ | 698,272 | $ | 83,891 | $3,940,064 | ||||||||||||||

| Donald E. Becker | |||||||||||||||||||||||||||||

| Executive Vice | |||||||||||||||||||||||||||||

| President | 2006 | $ | 575,413 | — | $ | 533,782 | $ | 576,090 | $ | 767,496 | $ | 711,031 | $ | 87,552 | $3,251,364 | ||||||||||||||

| (1) | This amount represents the dollar amount recognized for financial statement reporting purposes with respect to the fiscal year in accordance with FAS 123(R). See discussion of the assumptions made in the valuation in Note 10 to the financial statements in the Company’s Form 10-K filed with the SEC on April 4, 2007. Expense excludes 6.5% estimate of forfeitures, but includes an acceleration of expense for options granted to those reaching age 55 with at least five years of service. The named executive officers had no forfeitures in 2006. | |

| (2) | The Compensation Committee awarded a 141.118% payout for the executive officers including the named executive officers, in accordance with the terms of the 2006 performance-based cash bonus program. | |

| (3) | All amounts are attributable to change in pension value. During 2006, pension values increased significantly primarily due to increases in final average earnings used in determining pension benefits. Since the benefits are based on final average earnings and service, the effect of the final average earnings increase is larger for those with longer service. Please refer to the Pension Benefits table for further information regarding credited service. The Company does not provide any above-market or preferential earnings on nonqualified deferred compensation. | |

| (4) | These amounts include the reimbursement of life insurance premiums in the amounts of $69,435, $16,745, $22,221, $44,213 and $43,187 for Mr. Dillon, Mr. Schlotman, Mr. McMullen, Mr. McGeorge and Mr. Becker, respectively. These amounts also include reimbursement for the tax effects of paying such premiums in the amounts of $43,321, $9,704, $13,438, $25,761 and $26,945 for Mr. Dillon, Mr. Schlotman, Mr. McMullen, Mr. McGeorge and Mr. Becker, respectively. These amounts further include reimbursement for the tax effects of participation in a nonqualified retirement plan |

25

in the amounts of $16,885, $5,370, $8,871, $13,649, and $16,931 for Mr. Dillon, Mr. Schlotman, Mr. McMullen, Mr. McGeorge, and Mr. Becker, respectively. For Mr. Dillon and Mr. Becker these amounts also include the value of financial planning services in the amounts of $4,500 and $489, respectively. Reimbursement for financial planning services has been discontinued in 2007. Excluded from these totals is income imputed to the named executive officer when accompanied on our aircraft during business travel by non-business travelers. These amounts for Mr. Dillon and Mr. McGeorge, calculated using the applicable terminal charge and Standard Industry Fare Level (SIFL) mileage rates, were $8,296 and $268, respectively. The other named executive officers had no such imputed income for 2006. Separately, we require that officers who make personal use of our aircraft reimburse us for the full amount of the variable cost associated with the operation of the aircraft on such flights in accordance with a time-sharing arrangement consistent with FAA regulations.

Kroger historically has paid incentive compensation to its named executive officers based on the extent to which objectives established by the Committee are achieved. This compensation has been referred to as “bonus” in prior year proxy statements, but is now categorized as “non-equity incentive plan compensation.”The amounts shown above as non-equity incentive plan compensation reflect the compensation earned in 2006 and payable in 2007. Kroger and Mr. Dillon were parties to a five-year employment agreement that expired on November 30, 2006 and was not renewed. Restricted stock awards were granted under a long-term incentive plan, and restrictions on those shares lapse with the passage of time.

26

GRANTSOF PLAN-BASED AWARDS

The following table provides information about equity and non-equity awards granted to the named executive officers in 2006:

| 2006 GRANTS OF PLAN-BASED AWARDS | |||||||||||||||||

| All | All Other | ||||||||||||||||

| Other | Option | ||||||||||||||||

| Estimated | Stock | Awards: | |||||||||||||||

| Possible Payouts | Estimated | Awards: | Number | ||||||||||||||

| Under | Future Payouts | Number | of | Exercise | Grant | ||||||||||||

| Non-Equity | Under Equity | of | Securities | or Base | Date Fair | ||||||||||||

| Incentive Plan | Incentive Plan | Shares | Under- | Price of | Closing | Value of | |||||||||||

| Awards | Awards | of Stock | lying | Option | Market | Stock and | |||||||||||

| Grant | Target | Target | or Units | Options | Awards | Price | Option | ||||||||||

| Name | Date | ($) | (#) | (#) | (#) | ($/Sh) | ($/Sh) | Awards | |||||||||

| (1) | (4) | ||||||||||||||||

| David B. Dillon | 1/29/2006 | $1,500,000 | |||||||||||||||

| 5/4/2006 | 120,000 | (2) | $2,392,800 | ||||||||||||||

| 5/4/2006 | 240,000 | (3) | $19.94 | $20.04 | $1,658,064 | ||||||||||||

| J. Michael Schlotman | 1/29/2006 | $ 450,000 | |||||||||||||||

| 5/4/2006 | 10,000 | (2) | $ 199,400 | ||||||||||||||

| 5/4/2006 | 20,000 | (3) | $19.94 | $20.04 | $ 138,172 | ||||||||||||

| W. Rodney McMullen | 1/29/2006 | $ 950,000 | |||||||||||||||

| 5/4/2006 | 30,000 | (2) | $ 598,200 | ||||||||||||||

| 5/4/2006 | 60,000 | (3) | $19.94 | $20.04 | $ 414,516 | ||||||||||||

| Don W. McGeorge | 1/29/2006 | $ 950,000 | |||||||||||||||

| 5/4/2006 | 30,000 | (2) | $ 598,200 | ||||||||||||||

| 5/4/2006 | 60,000 | (3) | $19.94 | $20.04 | $ 414,516 | ||||||||||||

| Donald E. Becker | 1/29/2006 | $ 543,868 | |||||||||||||||

| 5/4/2006 | 12,500 | (2) | $ 249,250 | ||||||||||||||

| 5/4/2006 | 25,000 | (3) | $19.94 | $20.04 | $ 172,715 | ||||||||||||

| (1) | These amounts represent the bonus base or potential of the respective named executive officer under the Company’s 2006 performance-based cash bonus program. As shown in the Summary Compensation table, actual payout was 141.118% of the bonus base of each named executive officer for 2006. | |

| (2) | This amount represents the number of restricted shares awarded under The Kroger Co. 2005 Long- Term Incentive Plan. | |

| (3) | This amount represents the number of stock options granted under The Kroger Co. 2005 Long-Term Incentive Plan. | |

| (4) | Options under The Kroger Co. 2005 Long-Term Incentive Plan are granted at fair market value of Kroger common stock on the date of the grant. Fair market value was defined as the average of the high and low trading prices of Kroger stock on the date of the grant. |

The Compensation Committee of the Board of Directors, and the independent members of the Board in the case of the CEO, established bonus bases, shown in this table as “target” amounts, for the non-equity incentive plan awards for the named executive officers. Amounts were payable to the extent that performance met specific objectives established at the beginning of the year. As described in the Compensation Discussion and Analysis, actual earnings can exceed the target amounts if performance exceeds the thresholds. Restrictions on restricted stock awards made to the named executive officers lapse in equal amounts on each of the five anniversaries of the date the award is made, as long as the officer is then in our employ. Any dividends declared on Kroger common stock are payable on restricted stock.

27

Non-qualified stock options granted to the named executive officers vest in equal amounts on each of the five anniversaries of the date of grant. Those options were granted at the fair market value of Kroger common stock on the date of the grant. Options are granted only on one of the pre-established regularly scheduled Board meeting dates.

OUTSTANDING EQUITYAWARDSAT FISCAL YEAR-END

The following table discloses outstanding equity-based incentive compensation awards for the named executive officers as of the end of fiscal year 2006. Each outstanding award is shown separately. Option awards include performance-based nonqualified stock options. The vesting schedule for each award is described in the footnotes to this table.

| OUSTANDING EQUITY AWARDS AT 2006 FISCAL YEAR-END | |||||||||||||||||||||

| Option Awards | Stock Awards | ||||||||||||||||||||

| Equity | |||||||||||||||||||||

| Equity | Incentive | ||||||||||||||||||||

| Incentive | Plan | ||||||||||||||||||||

| Plan | Awards: | ||||||||||||||||||||

| Awards: | Market | ||||||||||||||||||||

| Number | or Payout | ||||||||||||||||||||

| Equity | of | Value of | |||||||||||||||||||

| Incentive | Unearned | Unearned | |||||||||||||||||||

| Plan Awards: | Market | Shares, | Shares, | ||||||||||||||||||

| Number of | Number of | Number of | Number | Value of | Units or | Units or | |||||||||||||||

| Securities | Securities | Securities | of Shares | Shares or | Other | Other | |||||||||||||||

| Underlying | Underlying | Underlying | or Units of | Units of | Rights | Rights | |||||||||||||||

| Unexercised | Unexercised | Unexercised | Option | Stock That | Stock That | That | That | ||||||||||||||

| Options | Options | Unearned | Exercise | Option | Have Not | Have Not | Have Not | Have Not | |||||||||||||

| (#) | (#) | Options | Price | Expiration | Vested | Vested | Vested | Vested | |||||||||||||

| Name | Exercisable | Unexercisable | (#) | ($) | Date | (#) | ($) | (#) | ($) | ||||||||||||

| David B. Dillon | |||||||||||||||||||||

| 30,000 | $ | 13.44 | 5/15/2007 | 120,000(11) | $3,102,000 | ||||||||||||||||

| 35,000 | $ | 22.23 | 4/16/2008 | ||||||||||||||||||

| 35,000 | (6) | $ | 22.23 | 4/16/2008 | |||||||||||||||||

| 50,000 | $ | 27.17 | 5/27/2009 | ||||||||||||||||||

| 50,000 | (7) | $ | 27.17 | 5/27/2009 | |||||||||||||||||

| 175,000 | $ | 16.59 | 2/11/2010 | ||||||||||||||||||

| 35,000 | (8) | $ | 16.59 | 2/11/2010 | |||||||||||||||||

| 35,000 | $ | 24.43 | 5/10/2011 | ||||||||||||||||||

| 35,000 | (9) | $ | 24.43 | 5/10/2011 | |||||||||||||||||

| 56,000 | 14,000 | (1) | $ | 23.00 | 5/9/2012 | ||||||||||||||||

| 35,000 | (10) | $ | 23.00 | 5/9/2012 | |||||||||||||||||

| 168,000 | 42,000 | (2) | $ | 14.93 | 12/12/2012 | ||||||||||||||||

| 120,000 | 180,000 | (3) | $ | 17.31 | 5/6/2014 | ||||||||||||||||

| 60,000 | 240,000 | (4) | $ | 16.39 | 5/5/2015 | ||||||||||||||||

| 240,000 | (5) | $ | 19.94 | 5/4/2016 | |||||||||||||||||

28

OUSTANDING EQUITY AWARDS AT 2006 FISCAL YEAR-END Option Awards Stock Awards Equity Equity Incentive Incentive Plan Plan Awards: Awards: Market Number or Payout Equity of Value of Incentive Unearned Unearned Plan Awards: Market Shares, Shares, Number of Number of Number of Number Value of Units or Units or Securities Securities Securities of Shares Shares or Other Other Underlying Underlying Underlying or Units of Units of Rights Rights Unexercised Unexercised Unexercised Option Stock That Stock That That That Options Options Unearned Exercise Option Have Not Have Not Have Not Have Not (#) (#) Options Price Expiration Vested Vested Vested Vested Name Exercisable Unexercisable (#) ($) Date (#) ($) (#) ($) J. Michael Schlotman 9,000 $ 22.23 4/16/2008 8,000 (12) $206,800 9,000 (6) $ 22.23 4/16/2008 10,000 (11) $258,500 10,000 $ 27.17 5/27/2009 10,000 (7) $ 27.17 5/27/2009 50,000 $ 16.59 2/11/2010 10,000 (8) $ 16.59 2/11/2010 10,000 $ 24.43 5/10/2011 10,000 (9) $ 24.43 5/10/2011 16,000 4,000 (1) $ 23.00 5/9/2012 10,000 (10) $ 23.00 5/9/2012 48,000 12,000 (2) $ 14.93 12/12/2012 16,000 24,000 (3) $ 17.31 5/6/2014 8,000 32,000 (4) $ 16.39 5/5/2015 20,000 (5) $ 19.94 5/4/2016 W. Rodney McMullen 25,000 $ 13.44 5/15/2007 30,000 (11) $775,500 25,000 $ 13.44 5/15/2007 30,000 $ 22.23 4/16/2008 30,000 (6) $ 22.23 4/16/2008 30,000 $ 27.17 5/27/2009 30,000 (7) $ 27.17 5/27/2009 125,000 $ 16.59 2/11/2010 25,000 (8) $ 16.59 2/11/2010 25,000 $ 24.43 5/10/2011 25,000 (9) $ 24.43 5/10/2011 40,000 10,000 (1) $ 23.00 5/9/2012 25,000 (10) $ 23.00 5/9/2012 120,000 30,000 (2) $ 14.93 12/12/2012 30,000 45,000 (3) $ 17.31 5/6/2014 15,000 60,000 (4) $ 16.39 5/5/2015 60,000 (5) $ 19.94 5/4/2016

29

| OUSTANDING EQUITY AWARDS AT 2006 FISCAL YEAR-END | |||||||||||||||||||||||

| Option Awards | Stock Awards | ||||||||||||||||||||||

| Equity | |||||||||||||||||||||||

| Equity | Incentive | ||||||||||||||||||||||

| Incentive | Plan | ||||||||||||||||||||||

| Plan | Awards: | ||||||||||||||||||||||

| Awards: | Market | ||||||||||||||||||||||

| Number | or Payout | ||||||||||||||||||||||

| Equity | of | Value of | |||||||||||||||||||||

| Incentive | Unearned | Unearned | |||||||||||||||||||||

| Plan Awards: | Market | Shares, | Shares, | ||||||||||||||||||||

| Number of | Number of | Number of | Number | Value of | Units or | Units or | |||||||||||||||||

| Securities | Securities | Securities | of Shares | Shares or | Other | Other | |||||||||||||||||

| Underlying | Underlying | Underlying | or Units of | Units of | Rights | Rights | |||||||||||||||||

| Unexercised | Unexercised | Unexercised | Option | Stock That | Stock That | That | That | ||||||||||||||||

| Options | Options | Unearned | Exercise | Option | Have Not | Have Not | Have Not | Have Not | |||||||||||||||

| (#) | (#) | Options | Price | Expiration | Vested | Vested | Vested | Vested | |||||||||||||||

| Name | Exercisable | Unexercisable | (#) | ($) | Date | (#) | ($) | (#) | ($) | ||||||||||||||

| Don W. McGeorge | |||||||||||||||||||||||

| 18,000 | $ | 13.44 | 5/15/2007 | 30,000 | (11) | $ | 775,500 | ||||||||||||||||

| 18,000 | $ | 13.44 | 5/15/2007 | ||||||||||||||||||||

| 30,000 | $ | 14.77 | 7/17/2007 | ||||||||||||||||||||

| 22,500 | $ | 22.23 | 4/16/2008 | ||||||||||||||||||||

| 22,500 | (6) | $ | 22.23 | 4/16/2008 | |||||||||||||||||||

| 30,000 | $ | 27.17 | 5/27/2009 | ||||||||||||||||||||

| 30,000 | (7) | $ | 27.17 | 5/27/2009 | |||||||||||||||||||

| 125,000 | $ | 16.59 | 2/11/2010 | ||||||||||||||||||||

| 25,000 | (8) | $ | 16.59 | 2/11/2010 | |||||||||||||||||||

| 25,000 | $ | 24.43 | 5/10/2011 | ||||||||||||||||||||

| 25,000 | (9) | $ | 24.43 | 5/10/2011 | |||||||||||||||||||

| 40,000 | 10,000 | (1) | $ | 23.00 | 5/9/2012 | ||||||||||||||||||

| 25,000 | (10) | $ | 23.00 | 5/9/2012 | |||||||||||||||||||

| 120,000 | 30,000 | (2) | $ | 14.93 | 12/12/2012 | ||||||||||||||||||

| 30,000 | 45,000 | (3) | $ | 17.31 | 5/6/2014 | ||||||||||||||||||

| 15,000 | 60,000 | (4) | $ | 16.39 | 5/5/2015 | ||||||||||||||||||

| 60,000 | (5) | $ | 19.94 | 5/4/2016 | |||||||||||||||||||

| Donald E. Becker | |||||||||||||||||||||||

| 18,000 | $ | 13.44 | 5/15/2007 | 5,000 | (13) | $ | 129,250 | ||||||||||||||||

| 18,000 | $ | 22.23 | 4/16/2008 | 40,000 | (14) | $ | 1,034,000 | ||||||||||||||||

| 0 | 18,000 | (6) | $ | 22.23 | 4/16/2008 | 12,500 | (11) | $ | 323,125 | ||||||||||||||

| 18,000 | $ | 27.17 | 5/27/2009 | ||||||||||||||||||||

| 0 | 18,000 | (7) | $ | 27.17 | 5/27/2009 | ||||||||||||||||||

| 75,000 | $ | 16.59 | 2/11/2010 | ||||||||||||||||||||

| 0 | 15,000 | (8) | $ | 16.59 | 2/11/2010 | ||||||||||||||||||

| 12,500 | $ | 24.43 | 5/10/2011 | ||||||||||||||||||||

| 0 | 12,500 | (9) | $ | 24.43 | 5/10/2011 | ||||||||||||||||||

| 21,333 | 5,334 | (1) | $ | 23.00 | 5/9/2012 | ||||||||||||||||||

| 0 | 13,333 | (10) | $ | 23.00 | 5/9/2012 | ||||||||||||||||||

| 64,000 | 16,000 | (2) | $ | 14.93 | 12/12/2012 | ||||||||||||||||||

| 16,000 | 24,000 | (3) | $ | 17.31 | 5/6/2014 | ||||||||||||||||||

| 8,000 | 32,000 | (4) | $ | 16.39 | 5/5/2015 | ||||||||||||||||||

| 0 | 25,000 | (5) | $ | 19.94 | 5/4/2016 | ||||||||||||||||||

30

____________________

| (1) | Stock options vest on 5/9/2007. | |

| (2) | Stock options vest on 12/12/2007. | |

| (3) | Stock options vest at the rate of 20%/year with vesting dates of 5/6/2007, 5/6/2008 and 5/6/2009. | |

| (4) | Stock options vest at the rate of 20%/year with vesting dates of 5/5/2007, 5/5/2008, 5/5/2009 and 5/5/2010. | |

| (5) | Stock options vest at a rate of 20%/year with vesting dates of 5/4/2007, 5/4/2008, 5/4/2009, 5/4/2010 and 5/4/2011. | |

| (6) | Performance stock options vest on 10/16/2007 or earlier if performance criteria is satisfied prior to such date. | |

| (7) | Performance stock options vest on 11/27/2008 or earlier if performance criteria is satisfied prior to such date. | |

| (8) | Performance stock options vest on 8/11/2009 or earlier if performance criteria is satisfied prior to such date. | |

| (9) | Performance stock options vest on 11/10/2010 or earlier if performance criteria is satisfied prior to such date. | |

| (10) | Performance stock options vest on 11/9/2011 or earlier if performance criteria is satisfied prior to such date. | |

| (11) | Restricted stock vests at the rate of 20%/year with vesting dates of 5/4/2007, 5/4/2008, 5/4/2009, 5/4/2010 and 5/4/2011. | |

| (12) | Restricted stock vests on 5/9/2007. | |

| (13) | Restricted stock vests on 9/17/2007. | |

| (14) | Restricted stock vests as follows: 10,000 shares on 12/10/2007 and 30,000 shares on 12/8/2008. |

From 1997 through 2002, Kroger granted to the named executive officers performance-based nonqualified stock options. These options, having a term of ten years, vest six months prior to their date of expiration unless earlier vesting because Kroger’s stock price has achieved the specified annual rate of appreciation set forth in the stock option agreement. That rate ranged from 13 to 16%. To date, only the performance-based options granted in 1997 have vested.

OPTION EXERCISESAND STOCK VESTED

The following table provides the stock options exercised and restricted stock vested during 2006.

| 2006 OPTION EXERCISE AND STOCK VESTED | |||||||||

| Option Awards | Stock Awards | ||||||||

| Number of | Value | Number of | Value | ||||||

| Shares Acquired | Realized on | Shares Acquired | Realized on | ||||||

| on Exercise | Exercise | on Vesting | Vesting | ||||||

| Name | (#) | ($) | (#) | ($) | |||||

| David B. Dillon | 30,000 | $ | 247,950 | 75,000 | $ | 1,555,500 | |||

| J. Michael Schlotman | 18,000 | $ | 148,703 | 15,800 | $ | 326,725 | |||

| W. Rodney McMullen | 60,000 | $ | 607,800 | 50,000 | $ | 1,037,000 | |||

| Don W. McGeorge | 24,000 | $ | 268,874 | 50,000 | $ | 1,037,000 | |||

| Donald E. Becker | 66,000 | $ | 686,680 | 12,500 | $ | 287,925 | |||

Options granted under our various long-term incentive plans have a ten-year life and expire if not exercised within that ten year period.

31

PENSION BENEFITS

The following table provides information on pension benefits as of 2006 year-end for the named executive officers.

| 2006 PENSION BENEFITS | |||||||

| Number | Present | Payments | |||||

| of Years | Value of | During | |||||

| Credited | Accumulated | Last Fiscal | |||||

| Service | Benefit | Year | |||||

| Name | Plan Name | (#) | ($) | ($) | |||

| David B. Dillon | The Kroger Consolidated Retirement Benefit Plan | 11 | $ | 214,080 | $0 | ||

| The Kroger Co. Excess Benefit Plan | 11 | $ | 1,690,013 | $0 | |||

| Dillon Companies, Inc. Excess Benefit Pension Plan | 20 | $ | 1,106,543 | $0 | |||

| J. Michael Schlotman | The Kroger Consolidated Retirement Benefit Plan | 21 | $ | 280,755 | $0 | ||

| The Kroger Co. Excess Benefit Plan | 21 | $ | 560,846 | $0 | |||

| W. Rodney McMullen | The Kroger Consolidated Retirement Benefit Plan | 21 | $ | 247,540 | $0 | ||

| The Kroger Co. Excess Benefit Plan | 21 | $ | 1,278,621 | $0 | |||

| Don W. McGeorge | The Kroger Consolidated Retirement Benefit Plan | 27 | $ | 426,158 | $0 | ||

| The Kroger Co. Excess Benefit Plan | 27 | $ | 2,182,611 | $0 | |||